ESG reporting is essential to understanding and integrating ESG considerations into investment decisions. Disclosing ESG data provides greater transparency and accountability by supporting companies in setting goals on environmental, social and governance issues and tracking their progress against both objective industry benchmarks and their own year-on-year targets. As ESG has become an increasingly popular and mainstream investment strategy, the demand for credible, relevant ESG data has grown, and along with it, the need for reporting frameworks that can measure corporate adherence to sustainability standards and communicate this information to stakeholders.

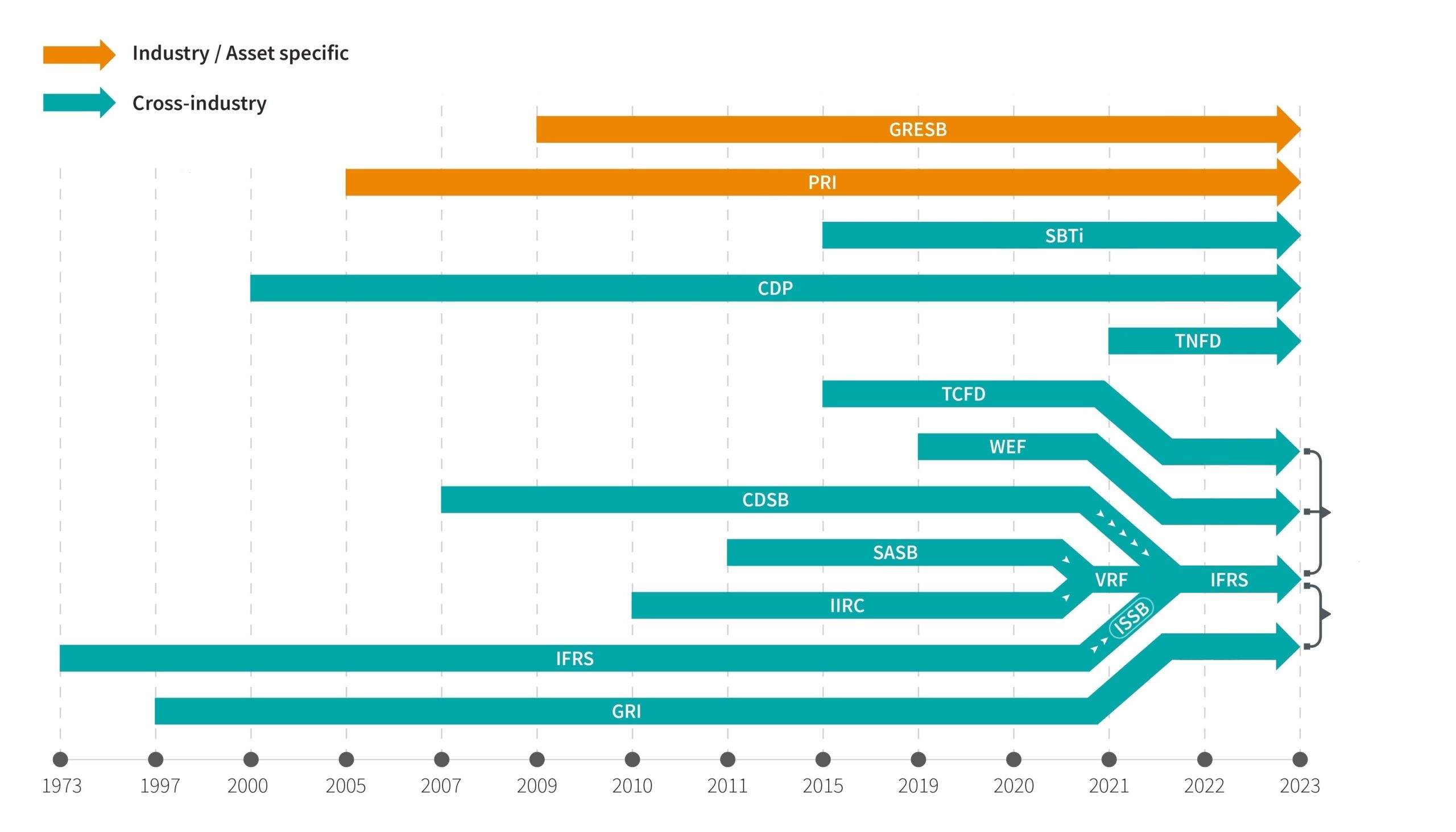

ESG reporting standards and frameworks are crucial to providing investors with consistent, comparable and decision-useful ESG information. One of the most significant issues in ESG reporting has been that information disclosed is often not comparable between companies, largely due to the proliferation of reporting frameworks, each with their own focus, targets and audience, and lack of standardization within the field. It is common for companies to use multiple standards and frameworks for their ESG reports and to use different accounting methodologies, metrics, measurement units, and report formats. However, in recent years, we have seen the consolidation of several large ESG reporting frameworks, and agreements among other frameworks to work together to coordinate their activities. Greater cooperation and alignment among standard-setting organizations will be an important step in streamlining the fragmented reporting landscape and providing greater clarity to investors, employees, customers and other stakeholders.

) for a brief description of each framework. Further information on the frameworks can be found in the tables below the diagram.

) for a brief description of each framework. Further information on the frameworks can be found in the tables below the diagram.