Income inequality is a top policy issue for the Obama administration and a focus of global private and public sector leaders at national and international forums. But what is driving income inequality, and what does it tell us about the future prospects for economic growth and social development?

Most experts agree that the central determinant of income inequality is when the share of national income going to capital (interest, dividends, and other realized investment returns) increases relative to income going to labor (wages, salaries, pension benefits, and other work-related compensation such as insurance benefits and incentive-based compensation).

A majority of economists also agree that a certain amount of inequality is essential for creating the pools of capital needed to drive investment in new ventures and technologies. This, in turn, is what drives and supports economic growth and social progress. While there is no clear agreement on what the optimum level of inequality should be in a country, it is agreed by most that excessive levels of either inequality or equality of incomes can have a negative impact on economic growth and social development.

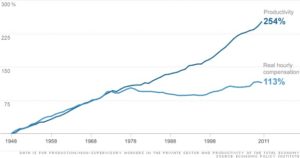

For most of the last half of the 20th century, income inequality has remained stable in Western economies. During the last two decades, however, labor’s share of total income has begun to decline steadily in favor of capital in most OECD countries, and as a result we have seen income inequality increase to new levels. This has raised alarm among politicians and policy makers.

As in other periods in history, rising inequality today reflects a time of economic transformation driven by a new wave of technological and management innovation. The first step in this latest change came when new shipping and communications technologies gave the private sector unprecedented access to a global labor market and supply chain. These innovations fueled what is now called “globalization,” creating a global economy in which countries and labor must now compete for capital investment and jobs. To compete in this marketplace, governments have found themselves forced to lower tariff barriers and tax rates to attract and retain capital investment. At the same time, most workers in OECD countries haves seen their wages stagnate or fall as they try to compete against cheaper labor from emerging markets. The twin forces of decreased taxation and cheaper labor have allowed capital’s share of income to increase throughout most the OECD, and in turn has driven up income inequality.

It is important to note however, that these same forces also have lifted hundreds of millions of people in developing economies out of poverty as they enter the global workforce. One recent study showed that on a global scale, the overall level of inequality actually remained roughly the same between 1989 and 2008, as countries like Brazil saw a marked drop in inequality.

It is important to note however, that these same forces also have lifted hundreds of millions of people in developing economies out of poverty as they enter the global workforce. One recent study showed that on a global scale, the overall level of inequality actually remained roughly the same between 1989 and 2008, as countries like Brazil saw a marked drop in inequality.

As we move further into the 21st century, an even greater technologically-driven economic transformation is on the horizon that will profoundly impact both developed and emerging markets. The driver for this change is the rapid growth of machine intelligence that is now poised to radically transform capital’s dependence on human labor. According to David Autor, an economist at the Massachusetts Institute of Technology who has studied the loss of middle-class jobs to technology, “It will be harder and harder to find things that people have a comparative advantage in versus machines.”

The impact of this decoupling of capital’s reliance on human labor, combined with a globalized labor market, is already having a profound impact on the workforce in the OECD, displacing millions of middle class jobs. In the US, half the 7.5 million jobs lost during the Great Recession were in industries that pay middle-class wages, ranging from $38,000 to $68,000. Only 2% of the 3.5 million jobs gained since the recession ended in June 2009 are in mid-pay industries. Nearly 70% are in low-paying industries while 29% are in high paying industries.

This emerging economic environment will pose a significant challenge to our current public policy and fiscal models built around a consumer economy and “full employment.” If smart machines increasingly replace paid employment as predicted, we can expect that the share of income going to capital will increase dramatically and income inequality will continue to rise in the absence of a public policy response. Among the challenges facing governments will be how best to ensure income distribution in society where paid employment may no longer be the primary means for gaining income for the majority of citizens. What will drive economic growth and demand if low-wage jobs increasingly replace middle-class jobs and the middle-class consumer economy stagnates? How will the federal government deal with the decline in the 40% of government revenues currently generated by middle-class payroll taxes? Can we replace the postindustrial service economy with a new “creative” economy and generate a new wave of middle-class jobs? If so, how do we prepare the current and future workforce for this new economy? What new roles will government, business and civil society have to play to ensure that we retain a social contract that can ensure both sustainable economic growth and social progress for all?

At High Meadows Institute we are looking at these questions and in particular how private sector leadership and ingenuity can help address them. We welcome your thoughts and invite you to share your insights using the response box below. For further information on this topic, please click below for a High Meadows published article on income inequality.

Economic Growth and Inequality: Why It Matters and What’s Coming Next